are hoa fees tax deductible in california

Deduct as a common business expense for your rental. Additionally an HOA capital improvement assessment could increase the cost basis of your home which could have several tax consequences.

San Francisco Property Taxes Kevin Jonathan Top San Francisco Real Estate Kevin K Ho Esq Jonathan Mcnarry Vanguard Properties 415 297 7462 415 215 4393

Are hoa fees paid on a rental property tax deductible.

. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. California real property owners can claim a 7000 exemption on their primary residence. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

Filing your taxes can be financially stressful. Exemption for California HOA Tax Returns. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood.

You can also deduct 10 of your HOA fees. You may be wondering whether this fee is tax deductible. Hoa fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas.

If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. When it comes to state taxes the laws differ from state to state. An HOA can dissolve depending on the CC.

Because the IRS views the cost of an HOA cost to be a necessary price for keeping the home any residential or commercial property used as a rental building is eligible for a tax reduction on the HOA charges. Are HOA Fees Tax Deductible. HOA fees are not tax-deductible unless the home is rented as a business expense.

The answer regarding whether or not your HOA fees are tax deductible varies depending on the situation. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. You can now deduct a total of 10000 in state and local property taxes if youre married and filing jointly and 5000 if youre single or married and filing separately.

There is an exception to the rule on. These fees are used to fund the associations maintenance and operations. 1 the organizational test.

The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. Mark the post that answers your question by clicking on Mark as Best Answer. Violating the CC.

You need not rent out your whole home for HOA costs to. However if the home is a rental property HOA. Employees working remotely for an employer will get no home office deduction.

It is important to remember that according to 2018s Tax Cuts and Jobs Act this deduction is only allowable for those who are self-employed. The quick answer to the question are HOA fees tax-deductible is. However the requirements are very similar to Internal Revenue Code section 528 for federal tax purposes.

When in doubt you should always consult a tax professional for official. Schoa Logo Sun City Arizona City Library Homeowners Association. However the new law only allows this tax deduction if you are self-employed.

If you only rent out a portion of your home such as a garage or the basement you can deduct a percentage of the HOA fees relative to the rest of the house. And 2 the operational test. Say Thanks by clicking the thumb icon in a post.

In general homeowners association HOA fees arent deductible on your federal tax return. If you pay less than 10000 of california tax your property tax deduction will be the difference between 10000 and your state income tax liability. Failure to pay HOA fees results in penalties including a lien on the home.

So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. For the 2020 tax year the standard deduction for single taxpayers and married taxpayers filing separately is 12400. An HOA can evict a homeowner for failing to pay dues and fees if the CC.

However the new law only allows. Year-round residency in your property means HOA fees are not deductible. It does this with the help of HOA dues fees that the association collects from members.

Are hoa fees tax deductible in ca. Are HOA fees tax deductible in California. So if your HOA dues are 4000 per year and you use 15 percent of your home as.

As a general rule no fees are not tax-deductible. There are some exceptions. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355.

A few common circumstances. You can reach HOA fees tax deductible status if you rent out your property either year-round or for a specific portion of the year. As a general rule no fees are not tax-deductible.

As a homeowner it is part of your responsibility to know when your HOA fees are tax-deductible and when they are not. There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual. To put it simply in this instance HOA dues are tax deductible as a rental cost.

Therefore if you use the home exclusively as a rental property you. However there are special cases as you now know. However you might not be able to deduct an HOA fee that covers a special assessment for improvements.

If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. If you are paying HOA fees its your responsibility to learn what your tax obligations are. There may be exceptions however if you rent the home or have a home office.

HOA fees on personal residence - not deductible. However if the home is a rental property HOA fees do become. There are some situations where HOA fees are tax-deductible and other cases where they arent.

In other words HOA fees are deductible as a rental expense. In order to meet tax exempt status in California the HOA must meet two main test. However if you have an office in your home that you use in connection with a trade or business then you may be able to deduct a.

The test requirements are outside the scope of this post. Are property taxes deductible in California 2020. Can I deduct property taxes in California 2020.

Your HOA may need to file a state homeowners association tax return depending on the location you are in. You dont need to rent out your entire home for HOA fees to become deductible. Are hoa fees tax deductible in california.

Are Hoa Fees Tax Deductible Here S What You Need To Know

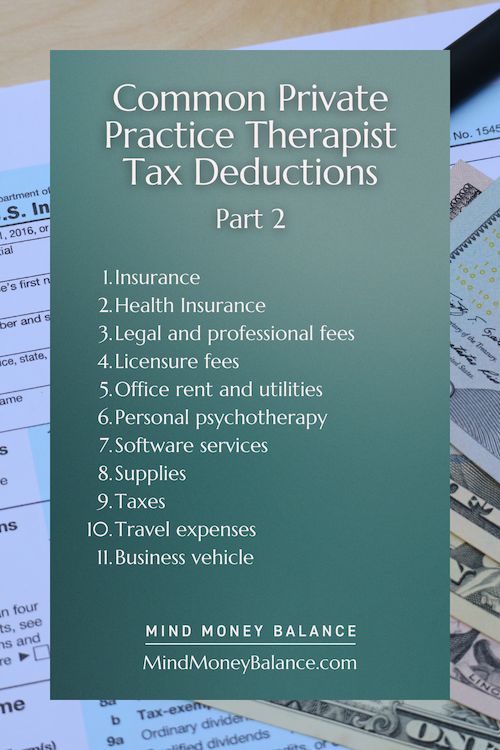

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Inman Here S A List Of Tax Deductions For Re Agents

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Clark Simson Miller

Hoa Tax Return The Complete Guide In A Few Easy Steps Template

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Are Homeowners Association Fees Tax Deductible

How Is Rental Income Taxed Real Estate Tax Strategy Wealthfit

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Experian

Can I Write Off Hoa Fees On My Taxes

Can I Write Off Hoa Fees On My Taxes

How Electric Vehicle Tax Credits Work

Can I Write Off Hoa Fees On My Taxes

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

Closing Costs That Are And Aren T Tax Deductible Lendingtree